Projects

Here, you will find a collection of work showcasing my finance, data analysis, and programming skills. Each project aims to explore a different aspect of finance, tackling unique challenges and offering diverse perspectives.

The project calculates the price of European options before their expiry date using the Black-Scholes Model which is a differential equation that takes the following parameters into account:

- Risk-free rate

- Underlying security price

- Strike price

- Time before the expiry

- Standard deviation

The project creates buy and sell signals for the given ticker, timeframe, and band length using Bollinger Bands.

In order to avoid the look-ahead bias, the previous 1 and 2 days have been taken into account in each data point.

The project additionally applies trailing stop-loss in which the stop-loss percentage could be determined by the user.

The project calculates the Piotroski F-Scores of each company in the Dow Jones index, which is used to assess a company's financial strength. The F-Score takes a value between 0 and 9, 9 being the strongest. The final output returns a data frame in which the tickers and their

F-Scores are listed in descending order.

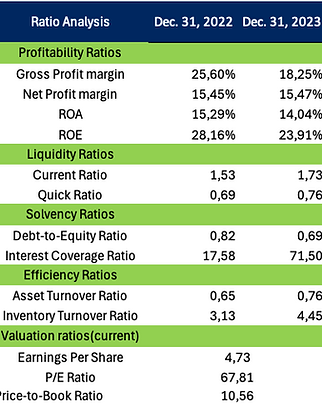

The project involves an in-depth analysis of Tesla's financial statements using Excel. It includes vertical and horizontal analysis to examine financial trends, ratio analysis to evaluate performance metrics, and quantitative techniques such as Alpha, Beta, CAPM, and Sharpe Ratio to assess risk and return. Additionally, it features a separate charting tool that allows users to compare Tesla's performance against the Nasdaq over a desired timeframe.